Ct Antique Car Tax

Existing law caps the value of antique motor vehicles for property tax assessment purposes at 500. The tax rate is determined by dividing the Grand Levy by the Grand List.

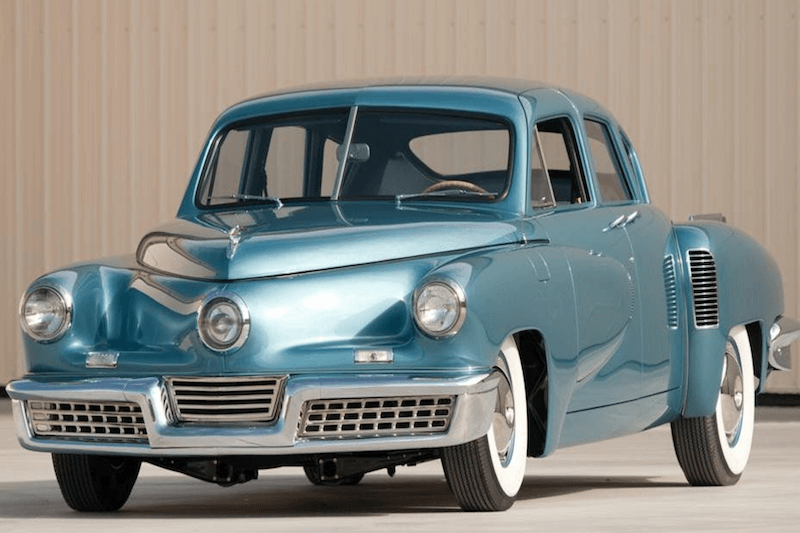

Account Suspended Sports Cars Luxury American Classic Cars Plymouth Cars

A tax rate mill rate of 1684 mills is equivalent to 1684 of taxes per 1000 of assessed value.

Ct antique car tax. Vehicles from the supplemental list require tax payment by Jan. When does my tax bill become delinquent. The sales tax is reasonable at 45 percent but theres also a steep excise tax of 45 percent that makes this one of the most tax-heavy states in the Union when it comes to registering a car.

18 2019 will receive their initial tax bill on Jan. Vehicles having classic license plates automatically get a 500 assessment. 5405 to increase the age requirement for vehicles eligible for registration as antique rare or special interest motor vehicles has been introduced in the Connecticut State Legislature.

Your tax collector will need to clear you online. The law also says that those with non-classic plates may be required by assessors to provide reasonable documentation that their vehicle is an antique. To qualify a vehicle must meet the statutory criteria required for an antique rare or special interest vehicle license plate issued by the DMV.

The vehicle must be currently registered in Connecticut with the Classic Vehicle plate design or the previous-design Early American plates. The vanity plate fee is 96. The Connecticut motor vehicle property tax.

ASSESSMENT LIMIT ON ANTIQUE VEHICLES DMV. Registered motor vehicles represent 64 of the total net Grand List value in Connecticut. DMV will no longer accept paper tax releases beginning November 16 2015.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Rolling back the cutoff date would thus reduce the number of collector car owners in the state who could take advantage of the antique vehicle tax cap and in turn and in combination with the lifted tax cap increase revenue for the. DEFINITION OF ANTIQUE VEHICLE FOR PROPERTY TAX PURPOSES By law the value of an antique rare or special interest motor vehicle for property tax purposes is limited to 500 CGS 12-71b.

Vanity plate options - see additional information. Connecticut Documentation Fees. In regards to the tax bill the value of an antique vehicle can be assessed at no more than 500 for tax purposes.

Only antique vehicles benefit from a property tax cap. The law allows tax assessors to require vehicle owners to provide reasonable documentation that the vehicle is an antique motor vehicle as described above. If you do not have the classic vehicle plate you may have to prove to the assessor that your car qualifies.

1 of the following year. Taxes must be paid within one month of the due date to avoid penalty interest. Average DMV fees in Connecticut on a new-car purchase add up to 87 1 which includes the title registration and plate fees shown above.

The local property tax is computed and issued by your local tax collector. Private Casual Sales - The purchase of passenger vehicles and light duty trucks 1991 model year and newer purchased from private owners is subject to 635 or 775 for vehicles over 50000 Connecticut Sales and Use Tax based on the NADA average trade-in value or bill of sale value whichever is higher. The tax on motor vehicles currently yields over 650 million each year across the state or nearly 183 per capita.

If your vehicle was built before 1 January 1981 you can stop paying vehicle tax from 1 April 2021. A little digging and I confirmed the law. These fees are separate from the taxes and.

Replacing Early American style plate with Classic Vehicle plate. For example an owner of a new vehicle registered with the DMV on Oct. The guides provide values for about 60-65 of registered vehicles and the rest are valued by assessors using other sources of information.

Vehicles from the regular list require tax payment by July 1. Any motor vehicle in Connecticut is subject to annual local property tax rates on 70 percent of its average retail value. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase of your vehicle.

Connecticut Introduces Bill to Limit Access to AntiqueRareSpecial Interest Motor Vehicle Registration Increase Property Taxes Legislation HB. If you do not know when your vehicle was built but it was registered before 8 January 1981 you. If you have the classic vehicle plate this is automatic.

Point and Pay charges taxpayers a convenience fee for processing credit card transactions. The fee for a standard credit card is 25 of the total with a 2 minimum fee and is disclosed before you approve the transaction completion. The bill requires the vehicles to be at least 25 years old to qualify for the cap.

If you do not register a motor vehicle but retain ownership you must annually file a declaration form with your assessors between October 1 and November 1. If a vehicle owner disputes the value the assessor has assigned to a vehicle he or she has a statutory right to appeal to the towns board of assessment appeals.

Donate Cars 4 Wishes Flyer Front Donate Car Wish Donate

What Are Historic License Plates How To Get One For Your Car The News Wheel

Holden Torana Ex Blue Bird Mobil Klasik Mobil Klasik

Vintage Auto Parked In The Polanco Neighborhood In Mexico City Mexicocity Mexico Cdmx Travel Cars Classiccars Classic Cars Mexico City The Neighbourhood

Rand Kelley Motors Lincoln Mercury Stamford Ct 1958 New Car Smell Lincoln Mercury Car Yard

Morris Vintage Car Model Cars Uk Old Classic Cars British Cars

1954 Ford Zephyr Six Consul Aussie Original Magazine Advertsement Ford Zephyr Ford Classic Cars Vintage Cars

How Old Does A Car Have To Be To Qualify For Classic Car Insurance

1978 Datsun 280z Nissan Cars Datsun Sports Car

Classic Cars Can Now Avoid Controle Technique

Car Donation Donate Car Vehicle Charity Donation Program Donate Car Vehicles Car

1972 Daimler Limousine Classic Car Tax Mot Exempt Wedding Classic Cars Best Classic Cars Limousine

Title Registration Classic Cars Vs Antiques Vs Vintage Etags Vehicle Registration Title Services Driven By Technology

Charities To Donate Car To Best Car All Time Best Donate Car Charity Donate

Pin By Stu Fisheer On British Leyland Associated Classic Cars British Cars Mercedes Benz Classic

Vintage Cars Door High Resolution Stock Photography And Images Alamy

Bmw Isetta 300 1957 Bmw Isetta Isetta Bmw Isetta 300

1961 Renault 4cv Resort Special Jolly For Sale In Portland Ct Asking 95k Renault Beach Cars Classic Cars

Pin By Carrick Esquivel On Police Car Brochures Ads Ford Police Police Cars Car Brochure